As of November 2023, US Credit Card rates have a median interest rate of 24.24%, with new credit cards offering an average rate of 24.56%. The applicant’s credit quality influences these rates, and the most favorable rates are reserved for those with excellent credit. Notable interest rates include U.S. Bank’s range of 19.24% to 29.99%, depending on the applicant’s credit and the specific card, along with a rate of 24.56% for new credit cards.

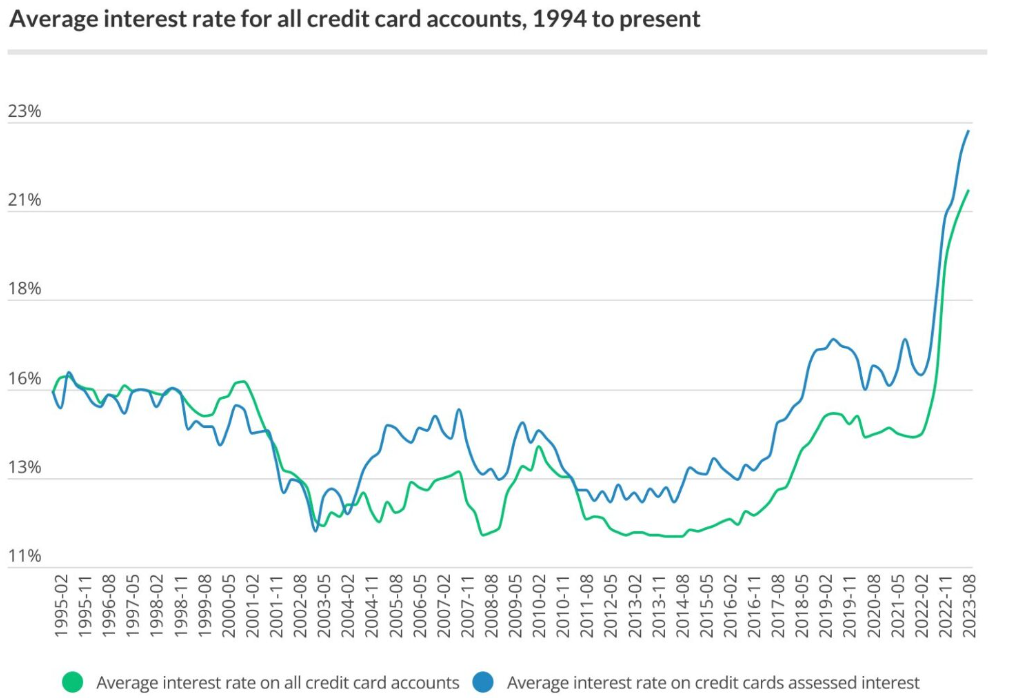

Before 2015, credit card rates were largely stable for several years, following the introduction of the Credit Card Accountability, Responsibility and Disclosure Act of 2009, better known as the Credit CARD Act. The pro-consumer law, signed by former President Barack Obama, brought enormous change to the credit card space. It set limits on when issuers could raise cardholders’ rates, changed how payments must be applied to balances, restricted certain fees and much more. Those changes forced issuers to scramble to figure out how to recoup the revenues lost under the CARD Act. As a result, credit card rates became volatile for several years.

Since the Federal Reserve started raising interest rates, credit card APRs have soared recently.Since most credit cards have a variable rate, there’s a direct connection to the Fed’s benchmark. As the federal funds rate rose, the prime rate did, as well, and credit card rates followed suit.

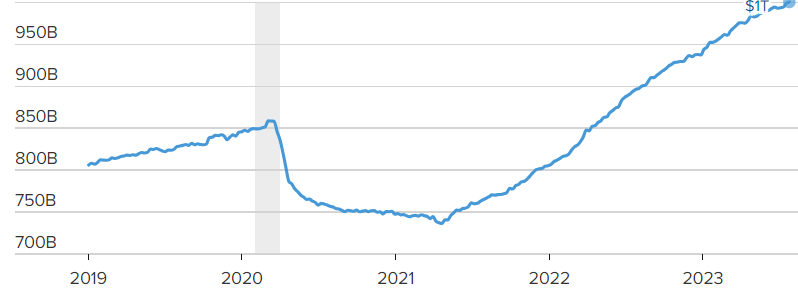

According to the Federal Reserve Bank of New York’s latest Quarterly Report on Household Debt and Credit, credit card debt in America has increased by $45 billion from Q1 of 2023. That represents a 4.6% increase in a single quarter, with cardholders shouldering thirteen-figure debt at $1.03 trillion for the first time.

Source: Federal Reserve Board via FRED