Heedfully crafted to create generational wealth for the highest quality of investors who are able to stand firm with long term view, irrespective of the current state of the markets.

Ever since stackpools alliance came into operation, we have been providing dedicated wealth management service to our partners. We are deeply grateful for having such quality of investors with us who are having right temperament when it comes to investing.

The universal structure of our investing includes (but not limited to) below mentioned core elements :

1. Value investing (dollar businesses for 50 cents or heavily discounted earnings from future cash flows)

2. Growth engines (EPS growth 25%+ QOQ)

3. Potential multibaggers (highest conviction companies which may not be available at cheap valuations)

4. US market (Nasdaq/NYSE)

5. Cash (convertible position)

6. New age businesses

7. Cigar butt investing/net-net approach (longer time frame)

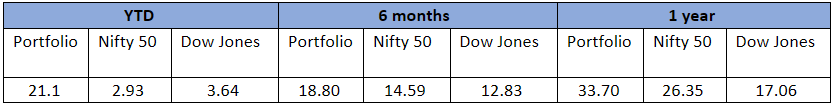

Performance update as of 1st March,2024

Returns for individual financial years:

| Year | Portfolio | Sensex | S&P 500 | Nasdaq Composite |

| 2021-22 | 58 | 18.48 | 13.08 | 5.80 |

| 2022-23 | -10.10 | -0.48 | -9.60 | -14.30 |

All values are in percentage (%) terms