The latest data on US CPI as released yesterday shows that inflation might be cooling faster than expected.

The U.S. Bureau of Labor Statistics confirmed that the CPI declined to 7.7% in October, 2022 from 8.2% in September, 2022. The Core CPI, which excludes volatile food and energy prices, fell to 6.3% from 6.6% on a yearly basis, compared to analysts’ expectations of 6.5%. The global markets rallied big with Nasdaq Composite climbing the most (7.35%) alongside S&P500, DJIA and DAX with gains of 5.54%, 3.70% and 3.51% respectively.

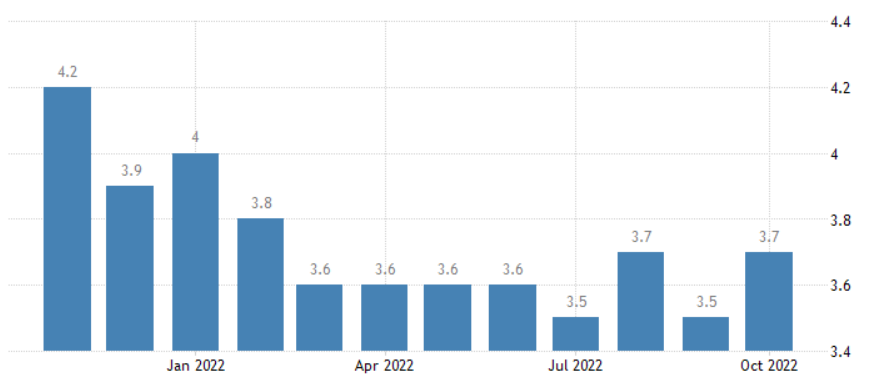

We believe that the market rally can sustain if the next month CPI confirms the similar downward trend. As a direct consequence, the Fed should not be doing any more 75 basis rate hike and it won’t be surprising to us if the Fed announces pivot in a more direct verbal statement or hint similar intention indirectly in next FOMC meet. However, the strongest caveat remains the historically low unemployment rate which suggests that the US labour market is still strong and there could be headroom for extended terminal fed funds rate if the Fed decides to give more weight to this particular data subset.

Last updated on April 20th, 2023 at 06:16 am