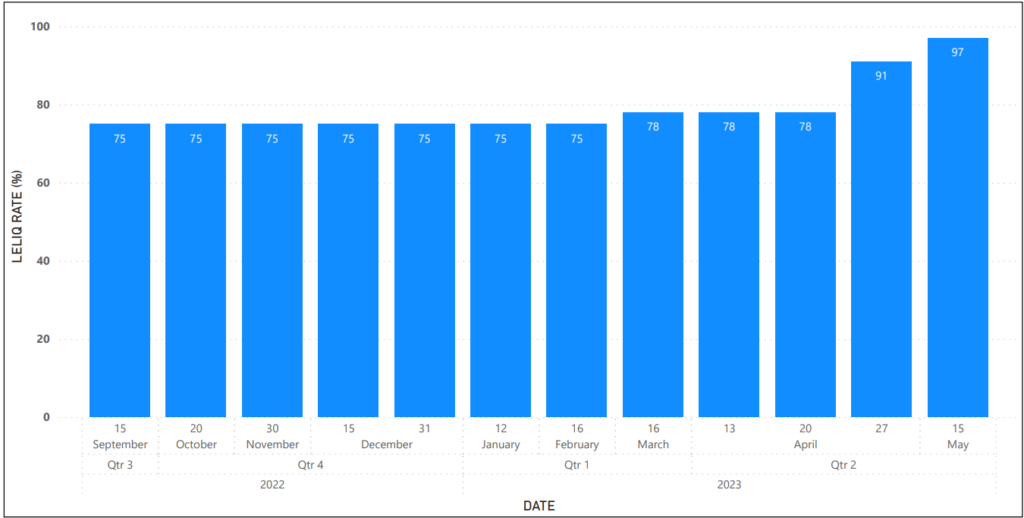

In a decisive move, the Central Bank of Argentina (BCRA) raised its benchmark interest rate (leliq) to 97% in a bid to counteract the rampant inflation which is running at 30 year high, pushing borrowing costs to their highest level. The step was taken in a emergency move to stop the sharp correction in value of Argentine Pesos against the basket of major currencies. The currency has plunged in range of 65-75% since 1st January, 2020 against USD,EURO,JPY and INR. Pesos (Argentine) lost 20% value against US Dollar within a single week during mid April which prompted the BCRA to respond with another major rate increase after 1000 basis points hike on 27th April.

Argentina’s inflation surpassed initial expectations, soaring to a staggering 108.8% on an annual basis in the month of April. Furthermore, it increased a concerning 8.4% on a monthly basis which is highest in 2 decades.

It’s worth mentioning that inflation surge which began post pandemic (due to enormous money printing by central banks) is not coming down evenly across the world. While US core inflation has cooled off to 4.9% (2% target still seems out of reach unless moderate recession hits), the inflation in Eurozone is hovering around 7% and UK remains the region with highest inflation (10.1%) in the western Europe.

In a official statement, the central bank (BCRA) said that the move was aimed at “preventing financial volatility from acting as a driver of inflation expectations.”

Last updated on May 19th, 2023 at 10:41 am